Borrowing Interest Rate

Design Rationale

The interest rate for borrowers in the protocol is automatically updated and implemented by the smart contract by considering the corresponding utilization rate. As a result, the borrowing rate is algorithmically adjusted and defined by a mathematical formula.

When determining the relationship between borrowing interest rates and the utilization rate, several factors were considered:

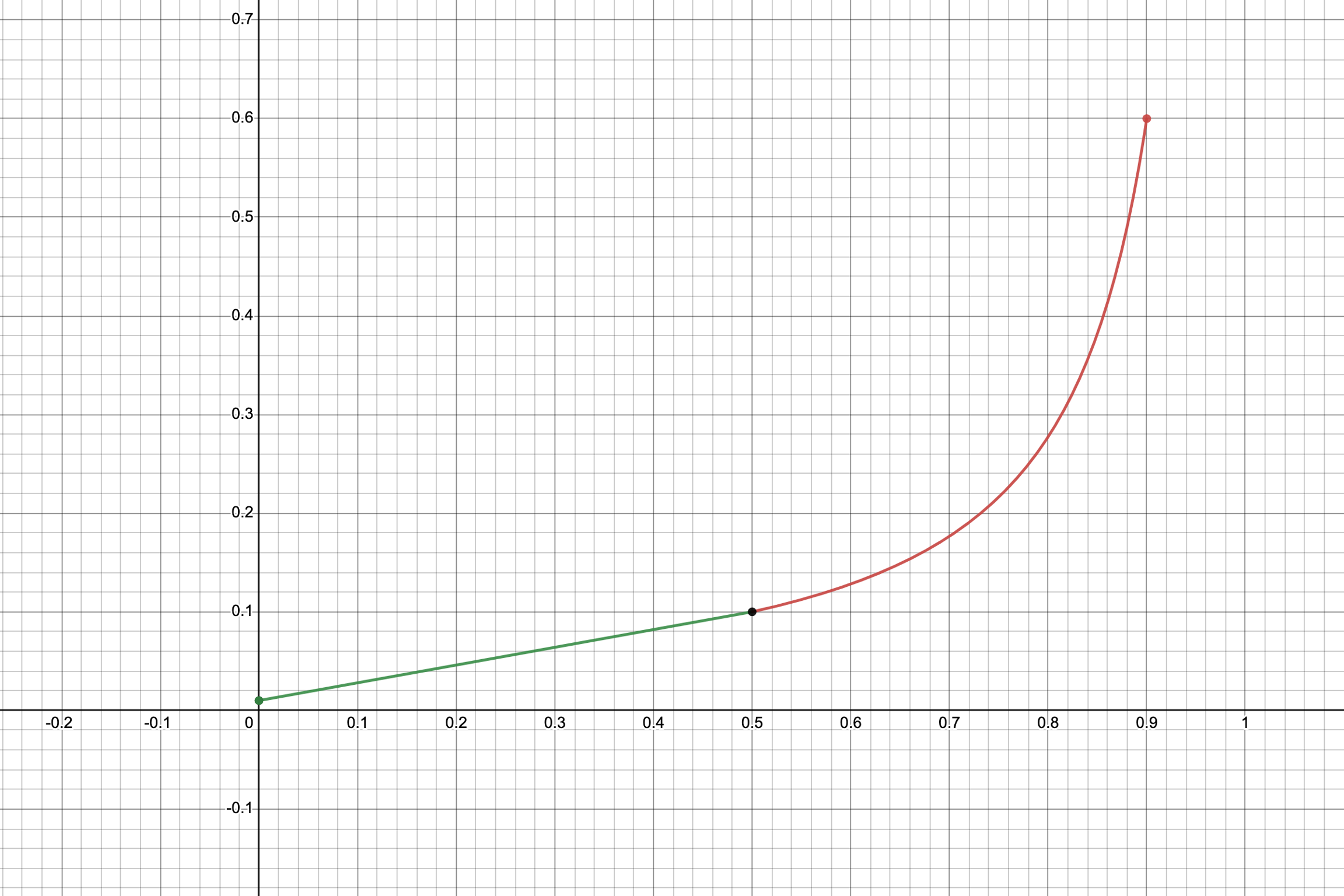

The utilization rate solely determines the borrowing rate. A high utilization rate indicates strong demand relative to supply, resulting in a higher interest rate to increase the cost of capital.

The marginal interest rate should be adaptable to changes in the protocol demand. The marginal interest rate, representing the slope of the interest rate curve, should consider diminishing marginal utility. For example, the slope of the curve could increase as the utilization rate rises.

The interest rate curve should be dynamic and programmable. Critical points, such as the minimum and maximum interest rates and the interest rate at an optimal utilization, should be defined to allow for flexibility in adjusting the interest rates.

Safeguarding mechanisms must be implemented to stabilize the borrowing rate at the inception stage. Safeguards need to be put in place to stabilize the interest rate and prevent the liquidity pool from shortages in the event of a sudden surge in utilization.

The following sections overview how we have implemented these factors into the design of the FILLiquid protocol through borrowing and repayment.

Borrowing and Repayment

Storage Providers (SPs) can borrow FIL tokens for the specific purpose of participating in the Filecoin consensus mechanism using the FILLiquid pool. The borrowed FIL can only be used as an upfront pledge for providing storage to ensure the security of the Filecoin system remains intact.

A critical factor in the model is that the borrowing interest rate considers the ex-post utilization rate. Without considering the ex-post utilization rate, the ecosystem could face rapid liquidity shortages by large loan requests from potentially malicious borrowing requests - particularly when the liquidity pool size is relatively small compared to the borrowing size.

As a result, when an SP submits a borrowing request, the system determines the interest rate based on the borrowing rate function according to the utilization rate while considering the ex-post utilization rate.

For instance, if the utilization rate is 10% before the request and increases to 20% after the borrowed FIL amount is subtracted from the pool, the corresponding borrowing interest rate should be based on the 20% utilization rate.

This approach safeguards the system from facing liquidity shortages. Miners can borrow up to the utilization rate ceiling with a maximum interest rate currently designed as 90% and 60%, respectively.

The borrower’s Filecoin Beneficiary Address [1] is transferred as collateral directly to the FILLiquid smart contract as soon as the borrowing contract is established. The transfer ensures that the smart contract for the FILLiquid pool gains control of the FIL rewards set to be unlocked during the borrowing period instead of the borrower.

Borrowers have the flexibility to initiate repayment at any time, as the loan terms are adjustable.

The interest is compounded continuously[2] but accrued every epoch[3] and is settled along with the principal repayment at the end of the loan term.

For example, an SP borrows at 50% utilization rate with a 10% nominal annual interest rate and plans to repay the loan over a period of 36 months would have to pay 34.986% of the principal as interest when repaying the loan at the end of the period.

[1] Only Beneficiary Role could withdraw FIL from an SP node. FIP-0029 proposed to re-assign the node control and financial benefit to different roles in order to provide more flexibilities for potential Filecoin financial market.

[2] Continuous compounding is the mathematical limit that compound interest can reach.

[3] Time in the Filecoin blockchain is discretized into epochs that are currently 30 seconds in length. Calculation of time: t=repaymentEpoch-borrowingEpoch